Recent Survey Results

As we poll our network using various survey tools and straight questions from other agencies, we want to make sure that we are sharing results and information to serve as a resource for immediate and future needs. See the information below for some of our more recent surveys. Scroll down to view other survey information.

Asked 9/27/22

We have a member that has been looking at their benefit package, specifically the 401k retirement savings plan component, and would like to get input on what others in the network are providing.

Network Responses

For the first 18 months of employment, employees pay into SSI. After 18 months, employees are given the option to 1) continue contributing to SSI, or 2) ATCAA will contribute 7% of their salary to a tax deferred retirement account at no cost to the employee. In either case, the employee is allowed to contribute after tax money to a retirement account once they have reached 18 months of employment.

For CRP we offer the following benefit package:

• Health - Kaiser or Sutter copay plans – Employees 100% covered by CRP, dependents are employee covered

• Vision through VSP but are switching to United HealthCare Vision due to larger provider options – Employee covered

• Aflac – Employee covered

• New York Life – Employee covered

• Employee Assistance Program (EAP) – CRP covered

• Premier Access Dental – Employees covered by CRP, dependents are employee covered

• Teladoc – Employee covered

This will be a new benefit to us this year as another option for employees who are having issues scheduling non-emergency appointments with their primary health provider. Works like EAP where all members in household are covered for a low monthly price to the employee.

• Retirement

We use The Standard as our retirement company

We offer two retirement plans

• 403b (401k equivalent) that is 100% employee contributed

• 401a Profit Sharing – We contribute up to 3% (at board discretion) of all eligible employees’ gross wages for the year directly into their 401a plan. We currently do not require our employees to have a 403b plan setup in order to have a 401a plan.

Pension Plan: After two years of continuous employment, employees are automatically enrolled in a Pension Plan. Fresno EOC contributes an amount equal to five percent (5%) of each employee’s compensation during the plan year at no cost to the employee. Employees can choose to contribute up to 10% of their compensation during the plan year.

403(b) Tax Deferred Retirement Plan

Employees have the option to save for retirement starting day one of employment by participating in our 403(b) Tax Deferred Retirement Plan. To help with investment decisions, employees can access Morgan Stanley to receive personalized investment advice.

41.4 Deferred Compensation Incentive:

A. The County will contribute eighty-five dollars ($85) per month to each employee who participates in the County’s Deferred Compensation Plan. To be eligible for this Deferred Compensation Incentive, the employee must contribute to the deferred compensation plan.

Employees who discontinue contributions or who contribute less than the required amount per month for a period of one (1) month or more will no longer be eligible for the eighty-five dollar ($85) Deferred Compensation Incentive. To reestablish eligibility, employees must again make a Base Contribution Amount as set forth above based on current monthly salary. Employees with a break in deferred compensation contributions either because of an approved medical leave or an approved financial hardship withdrawal will not be required to reestablish eligibility. Further, employees who lose eligibility due to displacement by layoff, but maintain contributions at the required level and are later employed in an eligible position, will not be required to reestablish eligibility.

B. Special Benefit for Permanent Employees Hired on and after January 1, 2011:

1. Beginning on April 1, 2011 and for the term of this resolution, the County will contribute one hundred and fifty dollars ($150) per month to an employee’s account in the Contra Costa County Deferred Compensation Plan, or other tax-qualified savings program designated by the County, for employees who meet all of the following conditions:

2. The employee must be hired by Contra Costa County on or after January 1, 2011. The employee must be appointed to a permanent position. The position may be either full time or part time, but if it is part time, it must be designated, at a minimum, as 20 hours per week.

3. The employee must have been employed by Contra Costa County for at least 90 calendar days.

4. The employee must contribute a minimum of twenty-five dollars ($25) per month to the Contra Costa County Deferred Compensation Plan, or other tax-qualified savings program designated by the County.

5. The employee must complete and sign the required enrollment form(s) for his/her deferred compensation account and submit those forms to the Human Resources Department, Employee Benefits Services Unit.

6. The employee may not exceed the annual maximum contribution amount allowable by the United States Internal Revenue Code.

C. No Cross Crediting: The amounts contributed by the employee and the County pursuant to Subsection B do not count towards the “Qualifying Base Contribution Amount” or the “Monthly Contribution Required to Maintain Incentive Program Eligibility” in Subsection A. Similarly, the amounts contributed by the employee and the County pursuant to Subsection A do not count towards the employee’s

$25 per month minimum contribution required by Subsection B.

D. Maximum Annual Contribution: All of the employee and County contributions set forth in Subsections A and B will be added together to ensure that the annual maximum contribution to the employee’s deferred compensation account does not exceed the annual maximum contribution rate set forth in the United States Internal Revenue Code.

E. Deferred Compensation Plan – Loan Provision: On June 19, 2012, the Board of Supervisors adopted Resolution 2012/298 approving an amendment to the County Deferred Compensation Plan, allowing a Deferred Compensation Plan Loan Program effective June 26, 2012. The following is a summary of the provisions of the loan program:

1. The minimum amount of the loan is $1,000.

2. The maximum amount of the loan is the lesser of 50% of the employee’s balance or $50,000, or as otherwise provided by law.

3. The maximum amortization period of the loan is five (5) years.

4. The loan interest is fixed at the time the loan is originated and for the duration of the loan. The loan interest rate is the prime rate plus one percent (1%).

F. There is no prepayment penalty if an employee pays the balance of the loan plus any accrued interest before the original amortization period for the loan.

G. The terms of the loan may not be modified after the employee enters into the loan agreement, except as provided by law.

H. An employee may have only one loan at a time.

I. Payment for the loan is made by monthly payroll deduction.

J. An employee with a loan who is not in paid status (e.g. unpaid leave of absence) may make his/her monthly payments directly to the Plan Administrator by some means other than payroll deduction each month the employee is in an unpaid status (e.g. by a personal check or money order).

K. The Loan Administrator (MassMutual Life Insurance Company or its successor) charges a one-time $50 loan initiation fee. This fee is deducted from the employee’s Deferred Compensation account.

L. The County charges a one-time $25 loan initiation fee and a monthly maintenance fee of $1.50. These fees are paid by payroll deduction.

We have a SIMPLE IRA plan. All employees are eligible as long as they earn a minimum amount during the year. We match the employee contribution up to 3% of their gross. The employee is allowed to choose their own investment company and can pick their own investments within whatever that company offers.

Riverside is one of the County Government CAAs, so our experience is going to be very different than the NGO CAAs in the network. We have a defined benefit pension that is part of CalPERS. We can also voluntarily contribute to a deferred compensation 457 plan.

We do a SEP IRA, up to 10% for employees with over 1 year of service.

We offer a 403B through Mutual of America. After one year they receive 3% of their salary as an agency contribution to their fund, and we will match an additional 3-1/4% if the employee also contributes 3-1/4%. So we will contribute a max of 6-1/4% total if the employee is also contributing.

Our agency has a 403B plan and provides a 60% match to all employee contributions to the plan.

Same deal at 8% match

We have a retirement program for employees with at least 1 year service at PACE. I believe we offer 5-6% of gross.

CAA Butte has a 403(b) plan through Mutual of America. It is my understanding many CAA’s across the country use M of A. After one year of employment we match an employee’s contribution up to 3.5% of their salary.

Asked 9/2/22

Have agencies compensated their employees (either incentive pay or merit increase) once one of those employees became a certified CSD Peer Expert that could assist in the OJT process?

Network Responses

The merit or incentive pay is only allowed if before the contract starts, the incentive is addressed. This means that the staff is:

1. Informed of his tasks/responsibilities and what will entail the incentive (e.g., overshooting targets, etc.)

2. Staff agrees with the above.

3. Incentive plan should be part of LSP policy (agency-wide)

4. CSD is informed

Our Lead Weatherization Specialist do this type of training and do not receive extra pay or incentives.

We don’t currently have staff in a position to be peer trainers, but we would definitely look at extra compensation for someone who was in that role.

There is a whole thing about bonuses. Each LSP must have their own policy about bonuses, that meet contract rules, if we are to use any CSD funds for them. What is listed below may be some of that language.

We do not have a formal program. But staff have been given bumps in pay rate after completing new training/certifications that help us better serve our clients.

We don’t call it merit or incentive pay. We just call it a straight increase in salary. I have worked in the construction field for over 18 years and I understand what it is to feel appreciated and what it feels like to unappreciated. Employee retention is my number one concern as it should be everyone’s #1 concern. Having a good workforce will make or break an Agency. Just my 2 cents.

Yes, we increase pay for an employee taking on additional responsibilities that wasn’t in their original job description. It keeps employee moral high, and it also shows that we as the employer appreciates them for taking on the additional responsibility. I feel it is only fair to the individual.

CAP OC does not compensate peer trainers. Mainly because we have always trained new employees in the field before sending them to certificate training. We also were able to get all of our experienced inspector/assessors certified as peer trainers so the training duty is not put onto one or two employee.

Our agency does not compensate a certified CSD approved Peer Expert

We do not provided additional pay.

Incentive pay/bonus pay not allowed under fed contracts unless there is a formal employment agreement in place. When an employee completes key training we increase their wages.

Asked 8/19/22

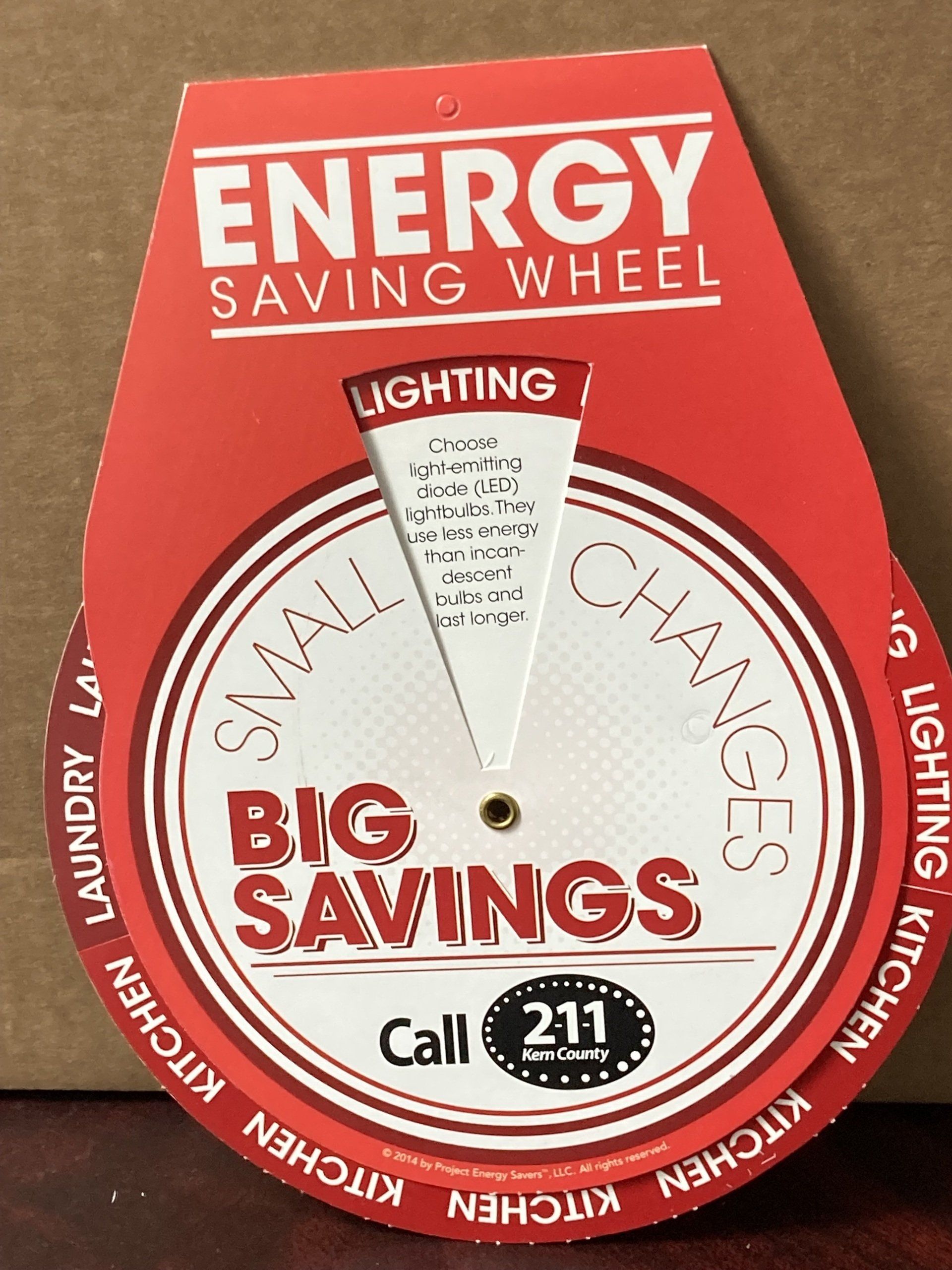

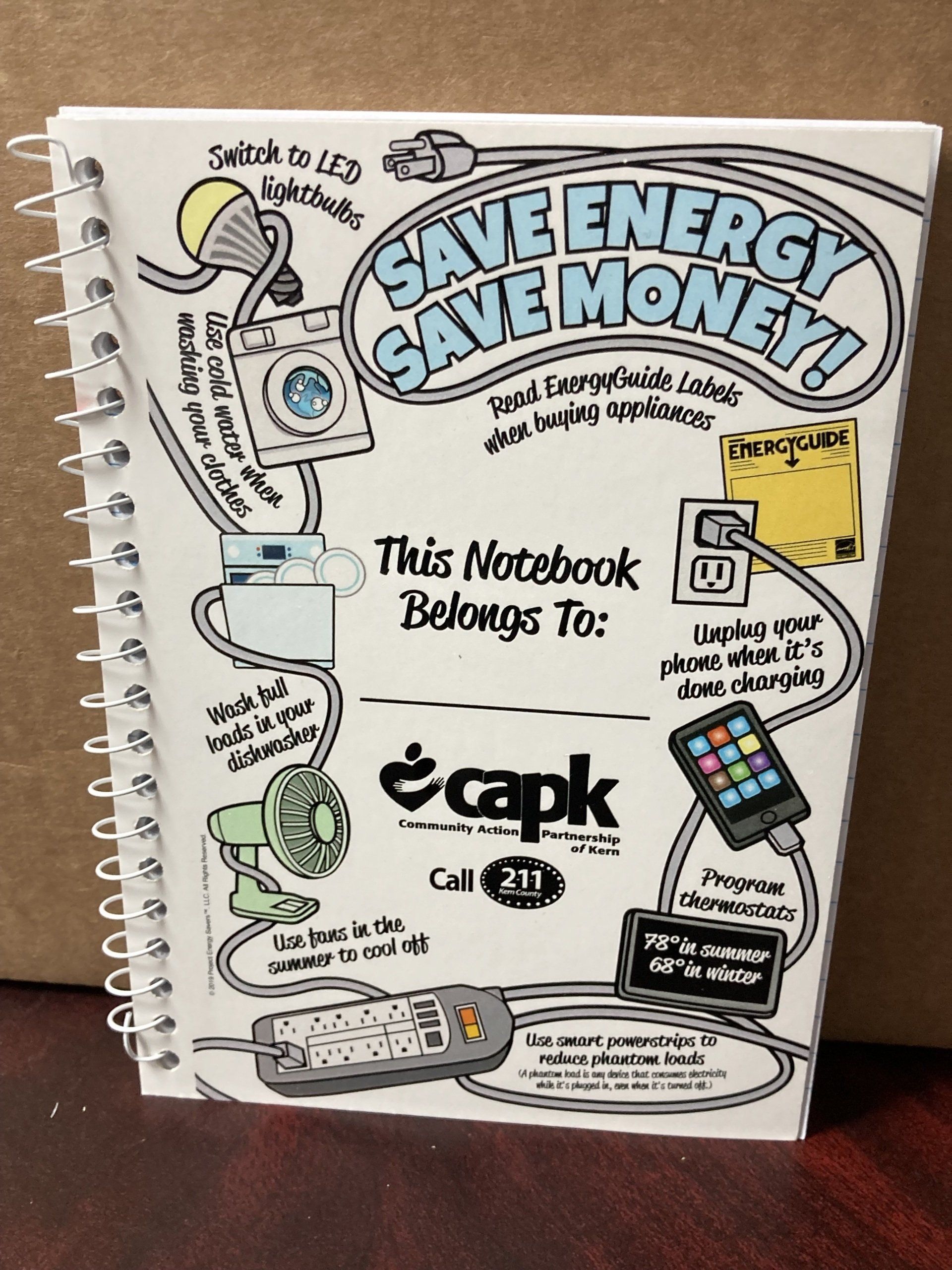

What type of outreach swag are people providing at outreach events that are being purchased under LIHEAP funding?

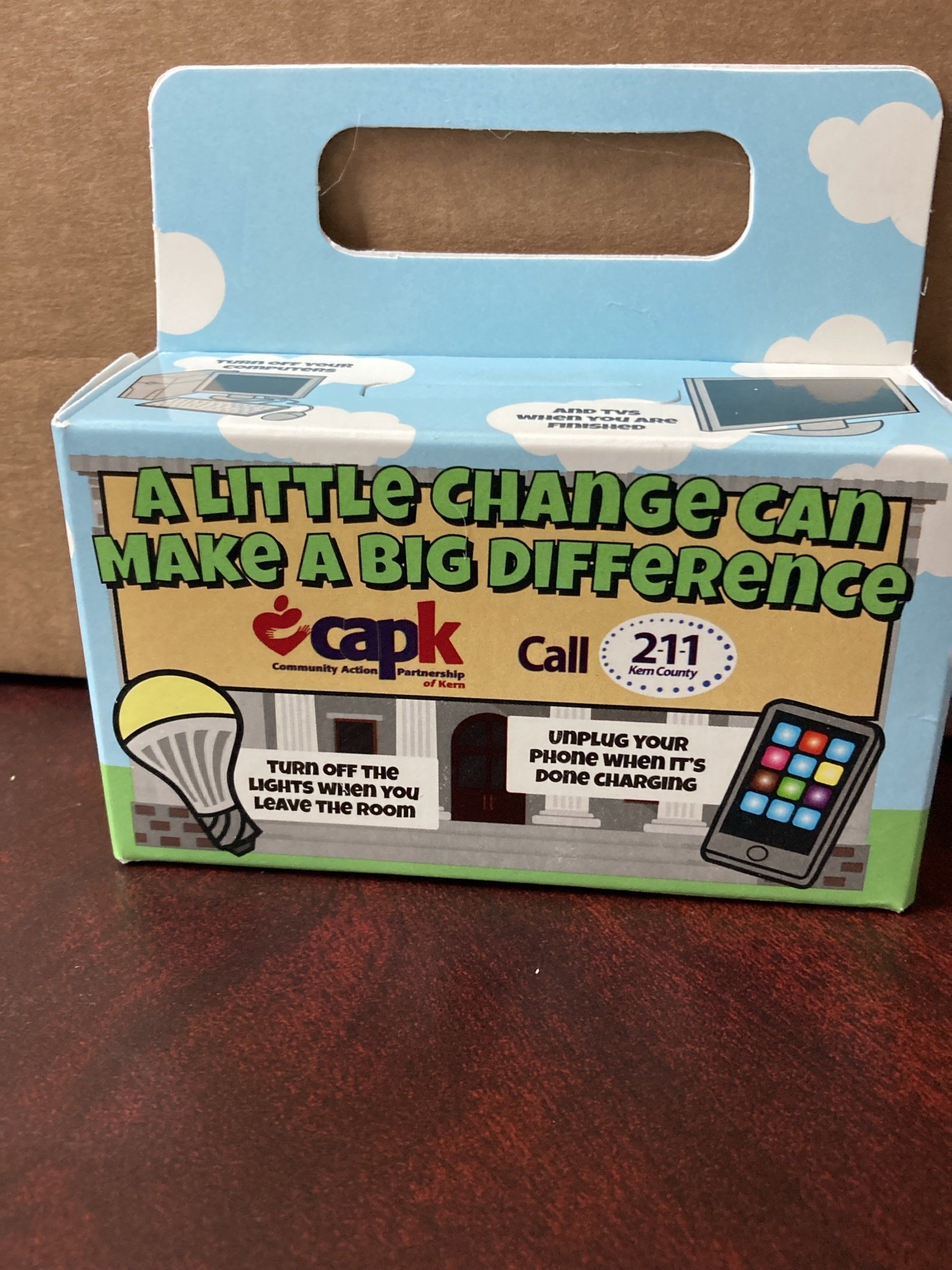

Network Responses (image samples below)

Reusable shopping back with agency name on front and 10 energy tips on back

Ten tips brochures Spanish and English

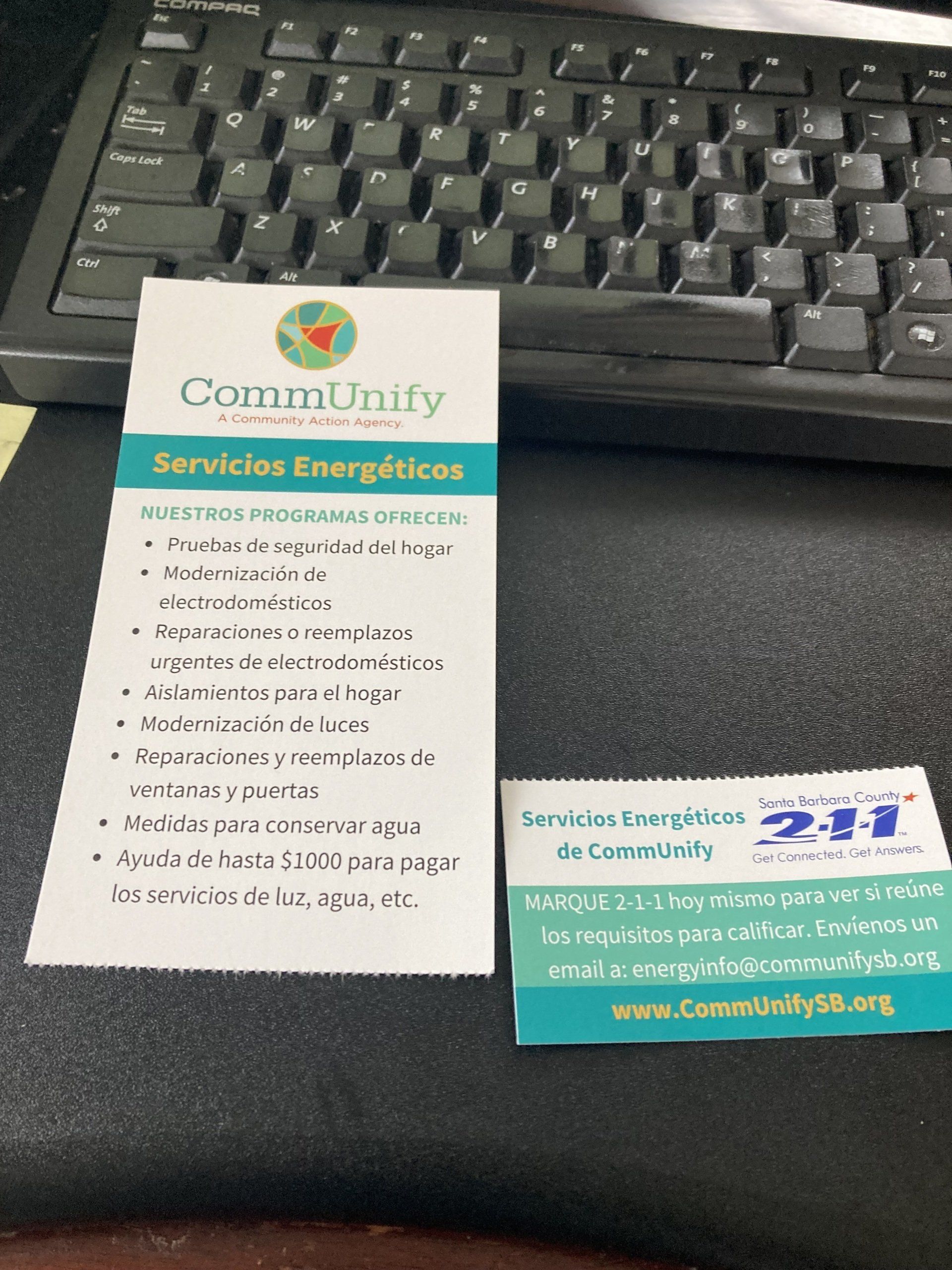

Rack Card to replace traditional flyer with perforated business card at the bottom double-sided Spanish and English

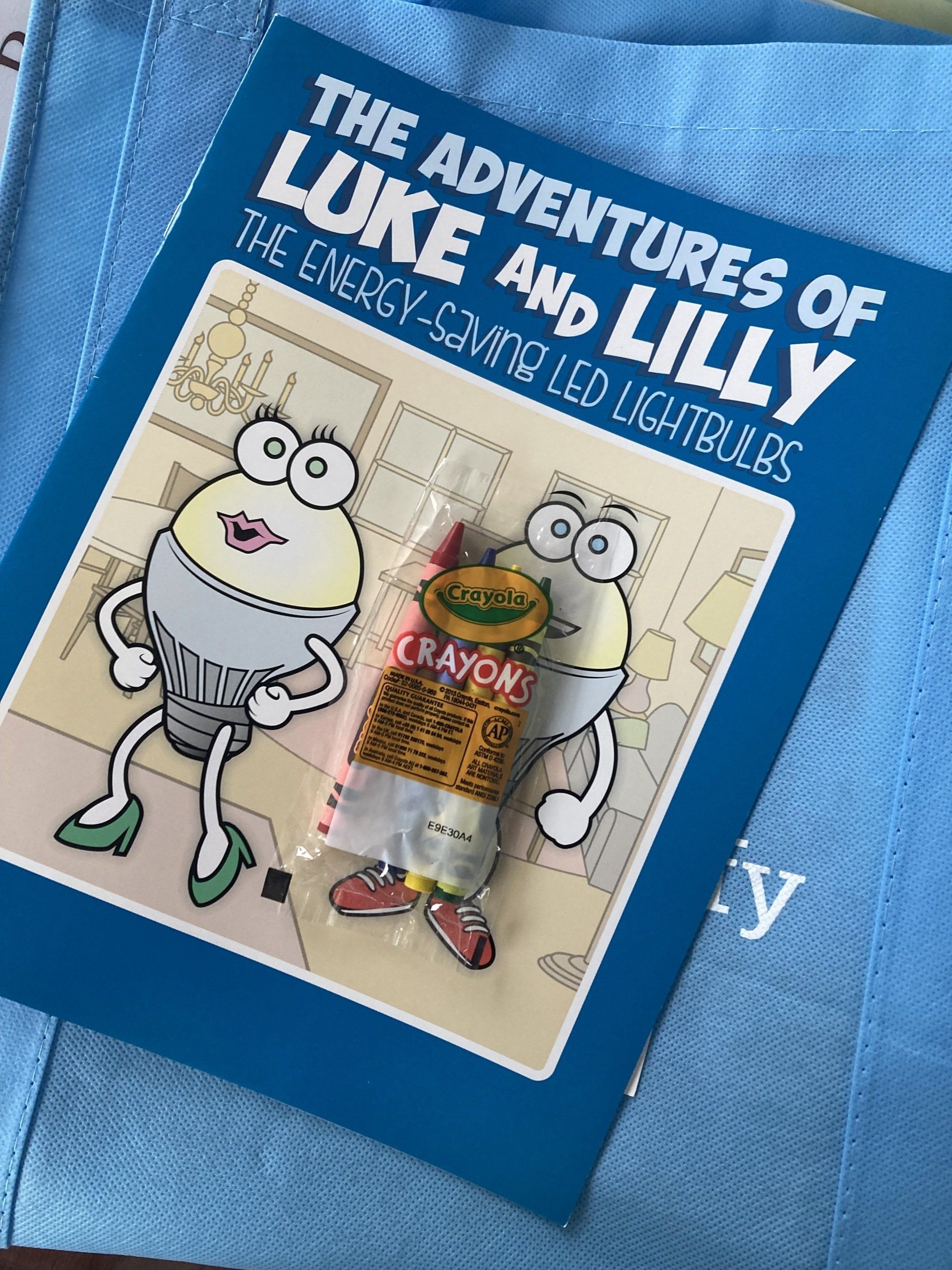

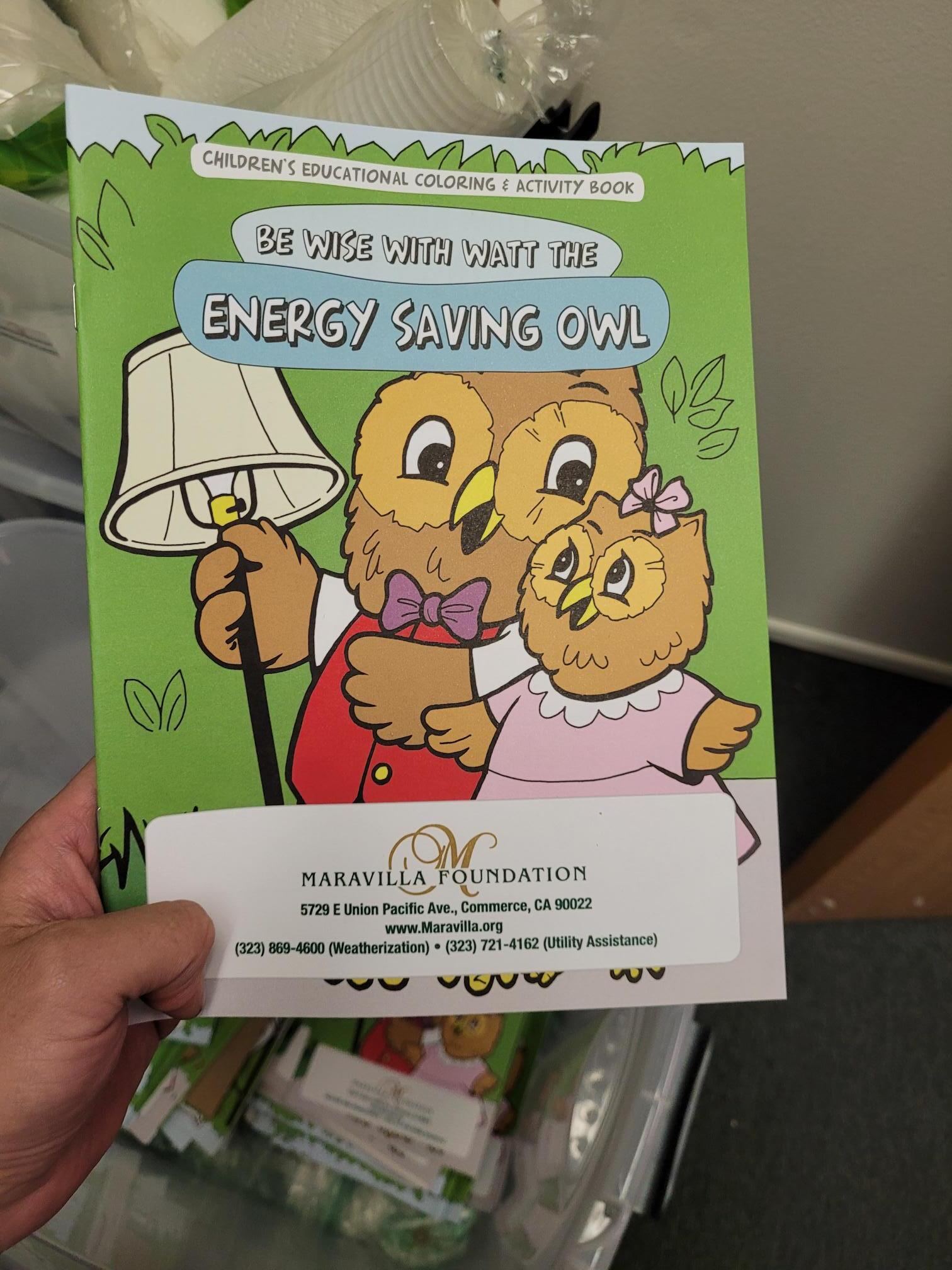

Energy Saving educational coloring book with crayons

PG&E provide many items such as bags, compacts/mirrors, micor fiber cloths and a myriad of other items and educational material. It’s the main bulk of the items we give out at events. We also acquired a number of small containers that we fill with hand sanitizer and apply a small sticker we printed with the agency logo and telephone number.

If the outreach event request games we will set up a simple game such as a ball toss where the kids will try to get a small beach ball, (provided by PG&E) into a number of small baskets. There will be small prizes such as a small bubble want, mini slinky, whistles, or any number of toys that you may find at an arcade.

We also have items that we install for the clients to look at such as what the inside of what an LED bulb looks like, a small container of insulation, a CO Alarm, and a few other items we may install through the weatherization program. In addition, we will also have a power point presentation continuously playing on a laptop describing some of the work the weatherization program does, how it will benefit them and how much money they may save per year.

If we have enough space at the booth we also take a Blower Door unit to educate the public on the type of testing that is done at a home. We do this to not only attract more clients to the booth but also educate the public as well as other agencies at the same event on the services provided by weatherization.

We give out Heat Smart blankets to all weatherization, PSPS and SWEATS clients, 1 per household member.

PGE provides what we use and they call it collateral.

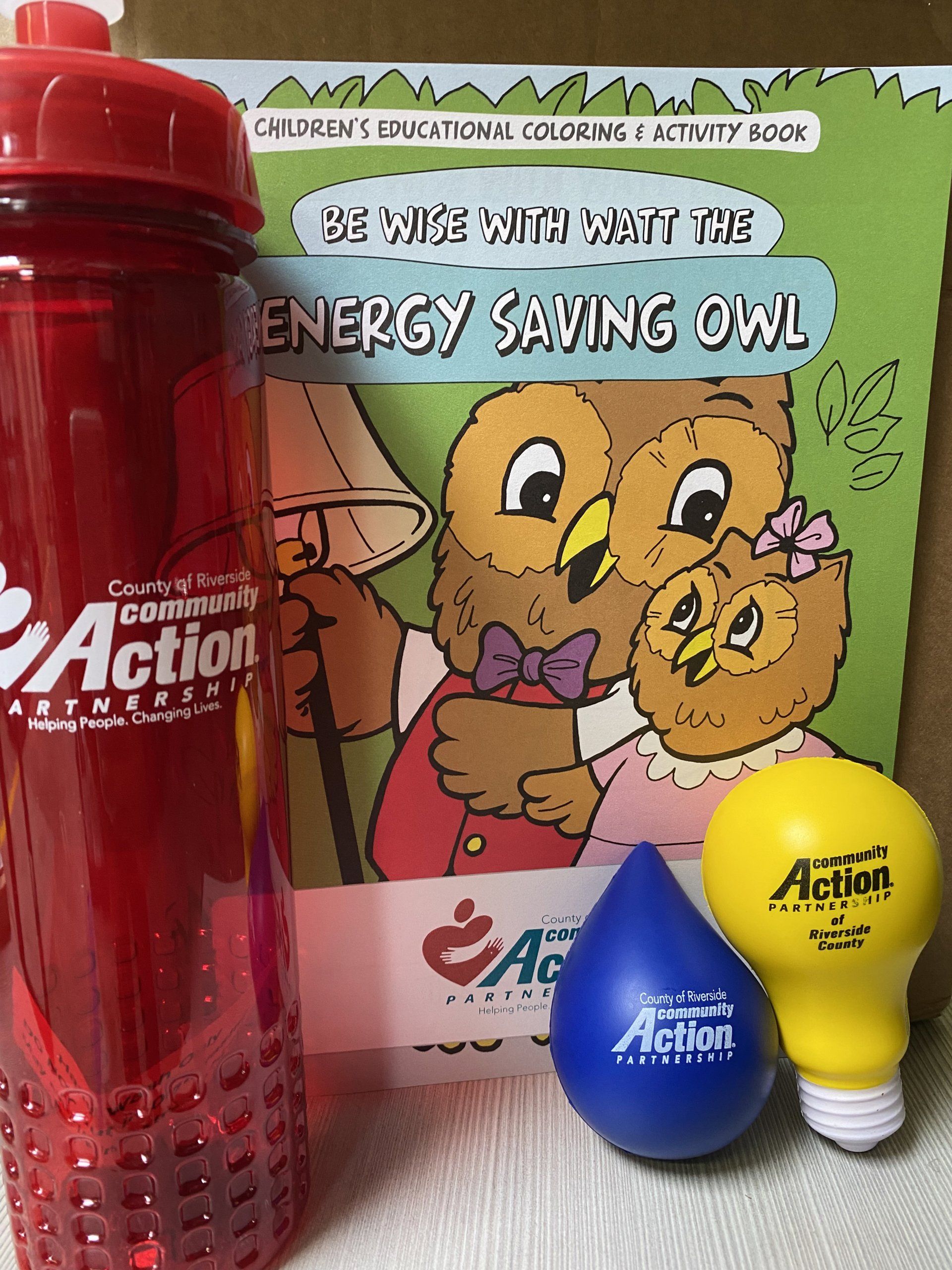

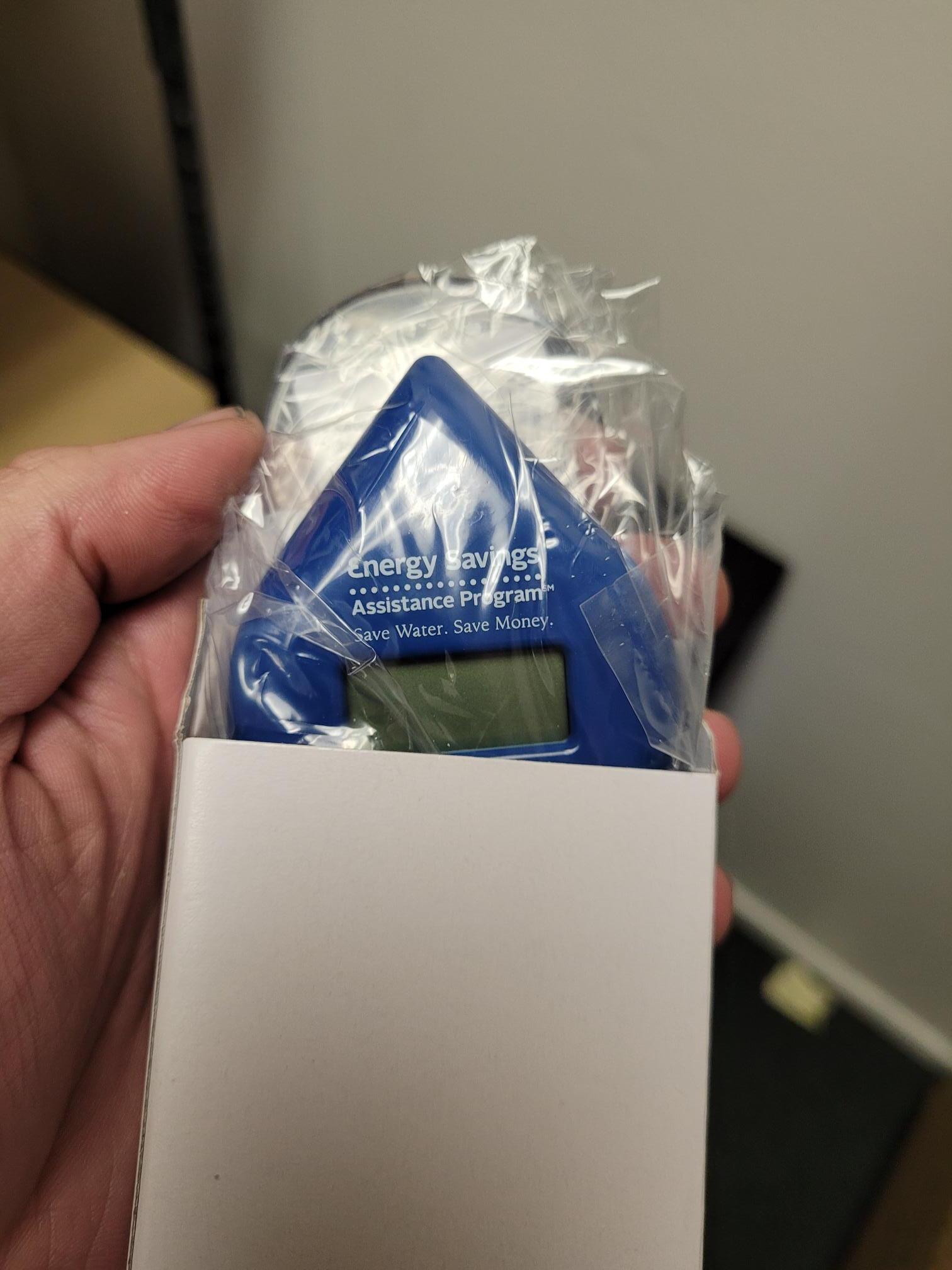

Attached is an image of the swag items we have ordered at CAP Riverside. The blue water drop stress “ball” was purchased for LIHWAP and of course the light bulb for LIHEAP. The coloring book does have the option to come individually wrapped with a small pack of crayons. In addition to these items, we also have mini first aid kits, and pens that double as a stylus. The vendor we use is Safeguard.

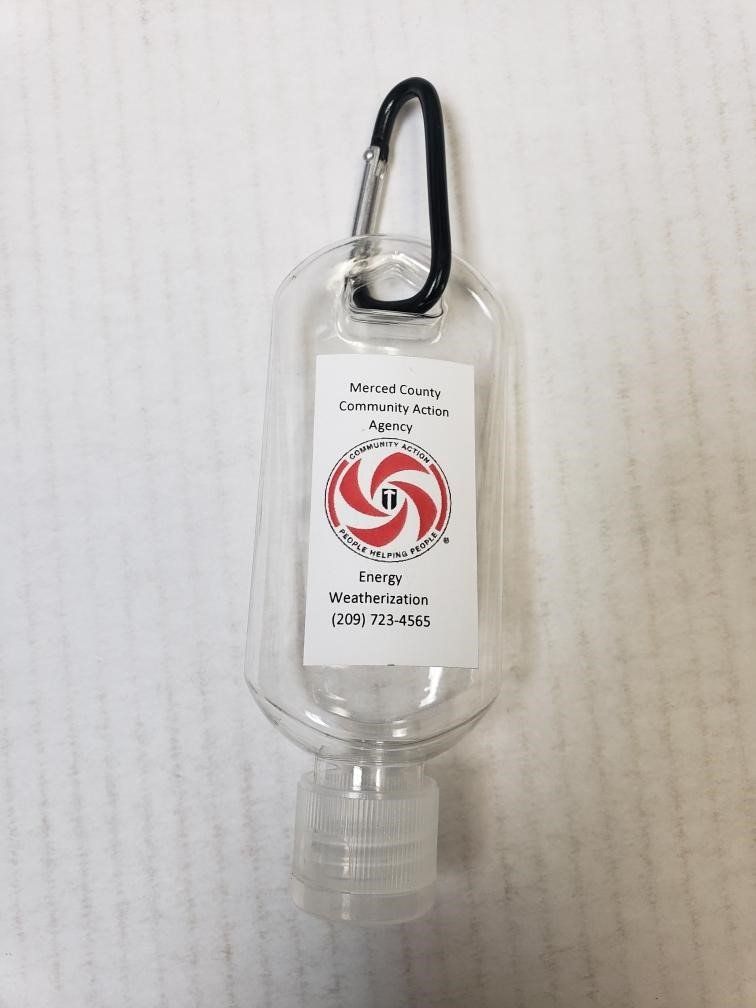

Pic of small hand sanitizer bottle we put our agency info on.

Alongside flyers and informational materials, we have a bunch of different branded things, including USB drives, pens, pencils, letter opener/ruler combo things, coffee mugs, water bottles, and the attached photos- canvas bags (which people like), cute children’s coloring books from the Energy Savers Project that do well with kids (and crayons to go with them), and water usage meters.

We don’t always bring all of this to events- some of the more expensive items (mugs, etc) are used to butter up property managers/owners when we’re trying to get them to sign the application forms!

We have created flyers in house with information on LIHEAP and WX and most recently LIHWAP that we just print in the office and take to outreach events. This is nothing that is billed back to LIHEAP.

Squeeze balls

Pens (blue ink to more easily read on apps!)

Hand-held fans

Business card sized magnifiers (to read the fine print!)

We have been able to get some cool swag from our utility companies, representing them with our prior Capitation Contract – signing up clients for their Care Program, and other utility programs.

As restrictions on in-person outdoor gatherings eased in Alameda County, and in anticipation of our participation in resource fairs during the hot summer months, we at Spectrum Community Services ordered logo/branded hand fans as giveaways. More practical and popular than our brochures, the double-sided fans have our contact info and QR code on one side, and graphical icons representing our five program offerings on the other. In addition, we distribute three other pieces of swag: ballpoint pens; business card-sized magnets with our contact info; and credit card-sized magnifiers for giveaways at events targeted at seniors and elderly.

First Aid kits

Water bottles

Magnets

Stress balls

We have purchased magnets with our information on there and cups.

Based on a recommendation from the CSD we give out products from Project Energy Savers.

https://projectenergysavers.com/

We did the A-16 Energy Kit, which doesn’t seem to be available anymore but was fairly similar to this one:

https://projectenergysavers.com/product/energy-saving-kit/

It’s pricy, so we don’t do it as SWAG, but reserve them for client who enroll at special events.

We also purchased several of their booklets and hand outs to use both with outreach and during Weatherization Assessments. They’ve been well received.

All Rights Reserved | Association of California Community and Energy Services Powered by Blue Hill Sites